0 TAX IS GONE!!!

PAYING TAXES AT A REASONABLE RATE IS OUR NEW GOAL

MID-SHORE OPTION MIGHT NOT BE THE DREAM OPTION, BUT IT IS THE BEST WE HAVE TODAY

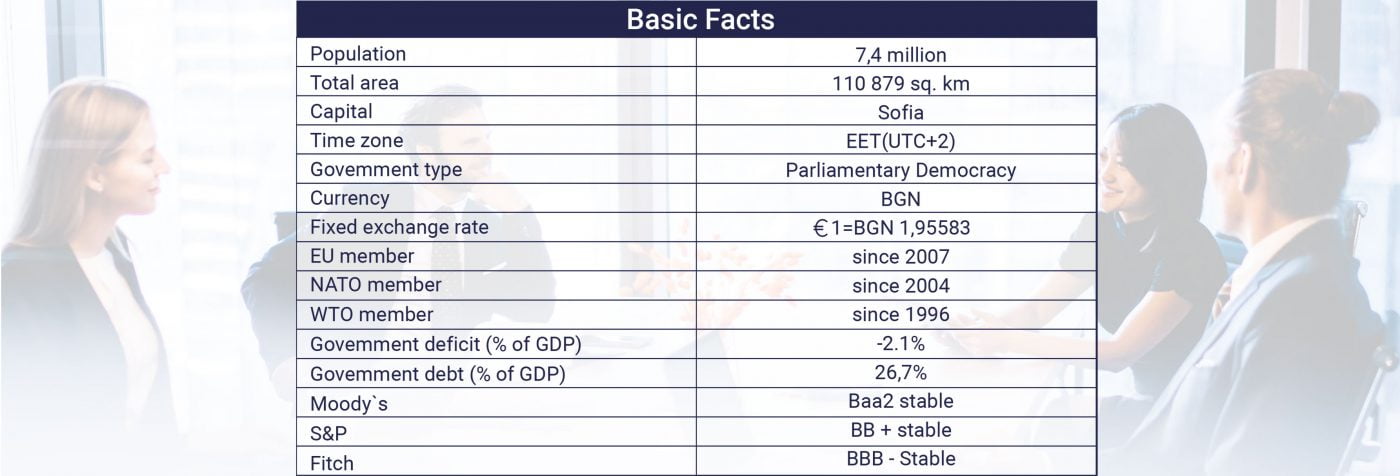

WHY BULGARIA

- Perfect Location

- Political Stability

- Stable country

- Less Financial Risk

- Tax Benefits

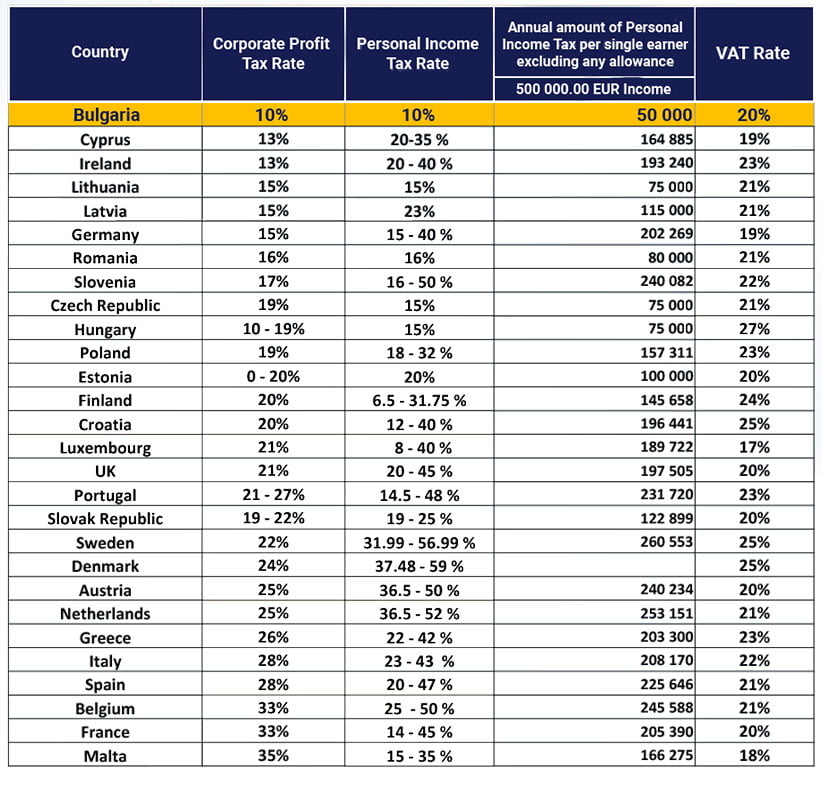

- Lowest Corporate Tax in the EU

- Lowest personal income tax in the EU

- Lowest social security contributions in the EU

- Low Business Costs

- Fewer rules compared to Western Europe, so good business climate

- Government policy focused on building favorable business climate for foreign investors.

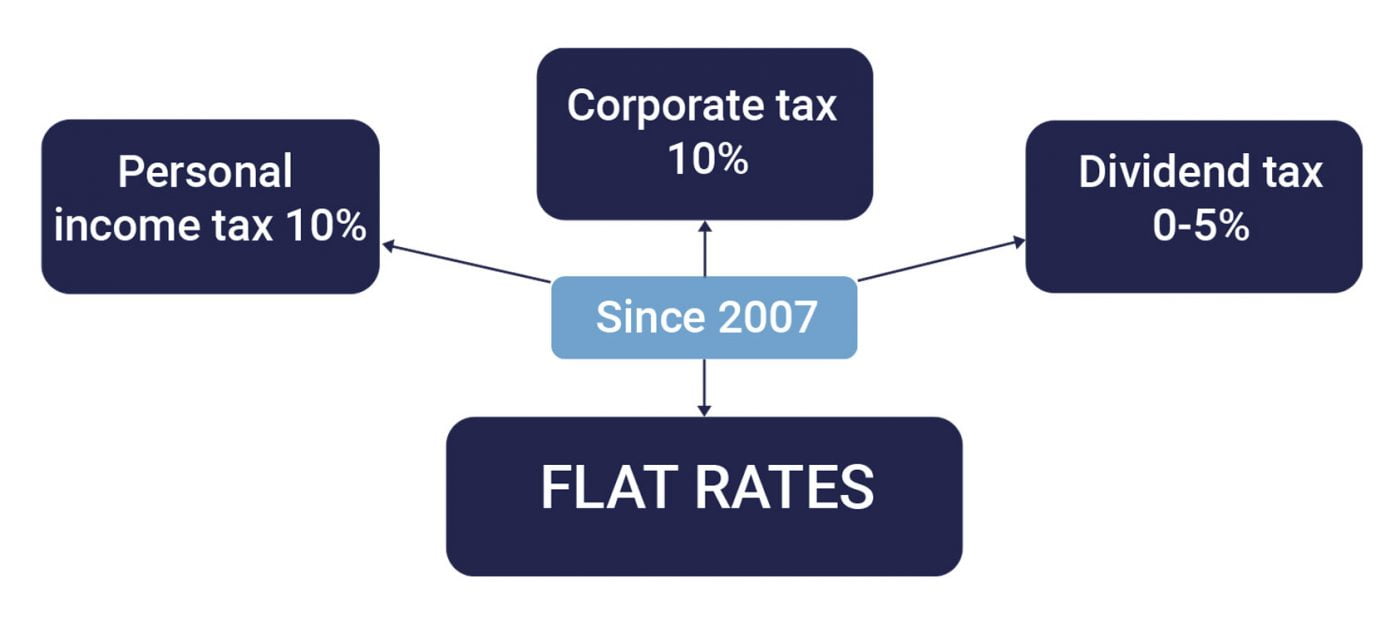

BULGARIAN TAX SYSTEM

TAXATION – LEGAL FRAME

- Bulgaria applies a worldwide income tax system and residents are taxable on their worldwide income at a rate of 10%

- Bulgarian companies are subject to a flat tax rate of 10% and the taxable profit is the annual financial result adjusted for tax purposes.

- Tax rates could be increased only if voted by 2/3 of the parliament members

- Since 2007

Sick and tired of paying taxes?

Become a Bulgarian tax payer!

BULGARIA TRADING COMPANY

- The Bulgarian trading company purchases and sells goods or services

- The goods or services are directly delivered by the supplier to the final client

- As a result the profit is transferred into the Bulgarian company, where profit is taxed at 10%

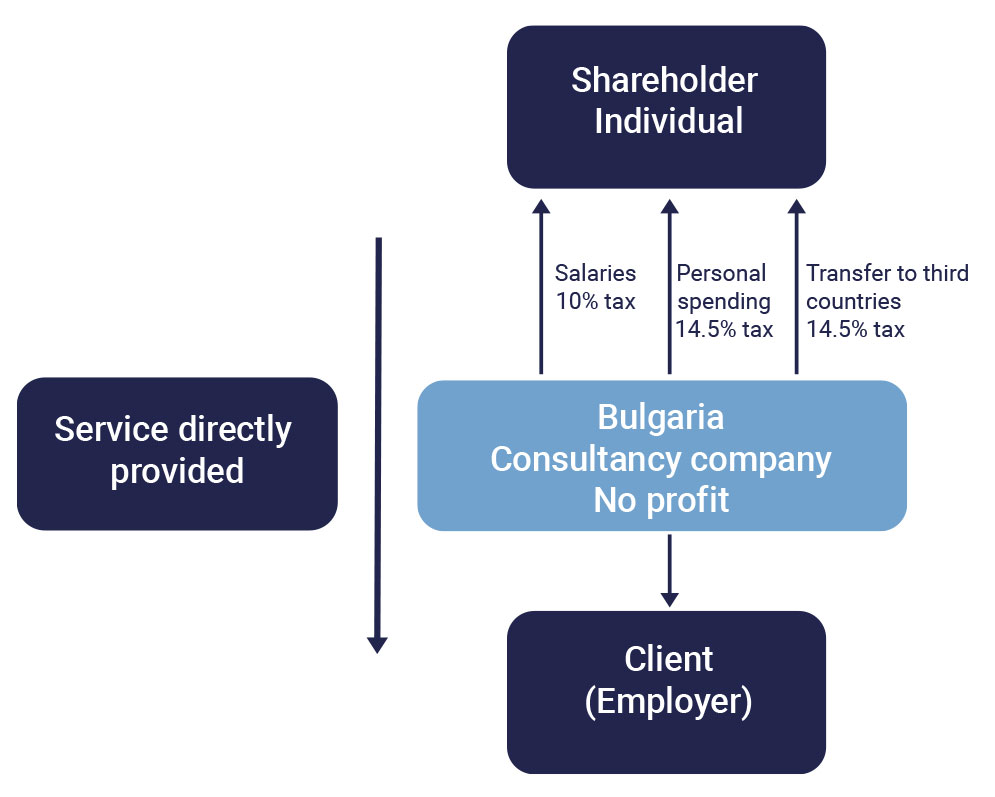

BULGARIA CONSULTANCY COMPANY

- The services are directly provided to the client/employer, but the Bulgarian company issues the invoices and collects the income

- The individual owner can receive a salary from his Bulgarian company, which is taxed at 10% in Bulgaria

- The individual owner can make personal spending from the Bulgarian company, which will be taxed at 14.5% in Bulgaria

- The individual owner can transfer funds to third countries (non EU), which will be taxed at 14.5% in Bulgaria

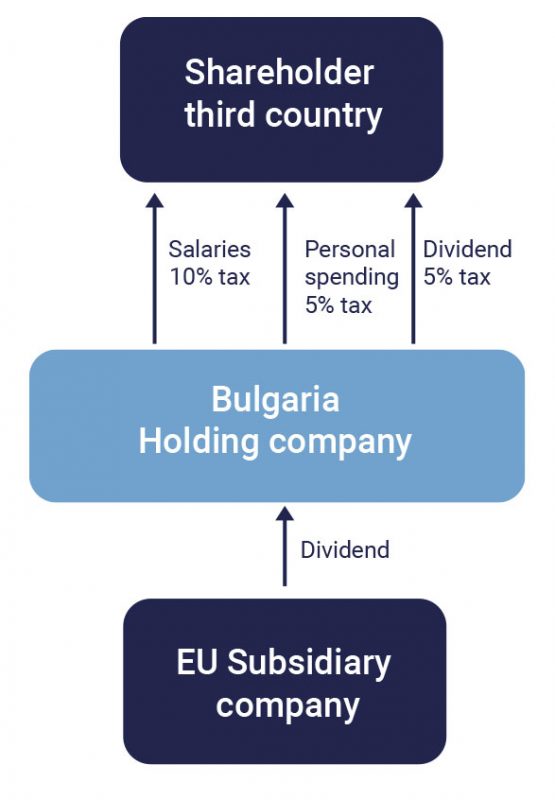

BULGARIA HOLDING COMPANY

- The services are directly provided to the client/employer, but the Bulgarian company issues the invoices and collects the income

- The individual owner can receive a salary from his Bulgarian company, which is taxed at 10% in Bulgaria

- The individual owner can make personal spending from the Bulgarian company, which will be taxed at 14.5% in Bulgaria

- The individual owner can transfer funds to third countries (non EU), which will be taxed at 14.5% in Bulgaria

10% PERSONAL INCOME TAX

FISCAL RESIDENCY – THERE IS

NOTHING TO DO WITH CITIZENSHIP

BULGARIAN ID CARD AND TAX RESIDENCY

- Social insurance number and ID Card

- Staying in Bulgaria – substance

- Center of vital interest – substance

- Personal income tax return

INVESTMENT AND BUSINESS OPPORTUNITIES IN BULGARIA

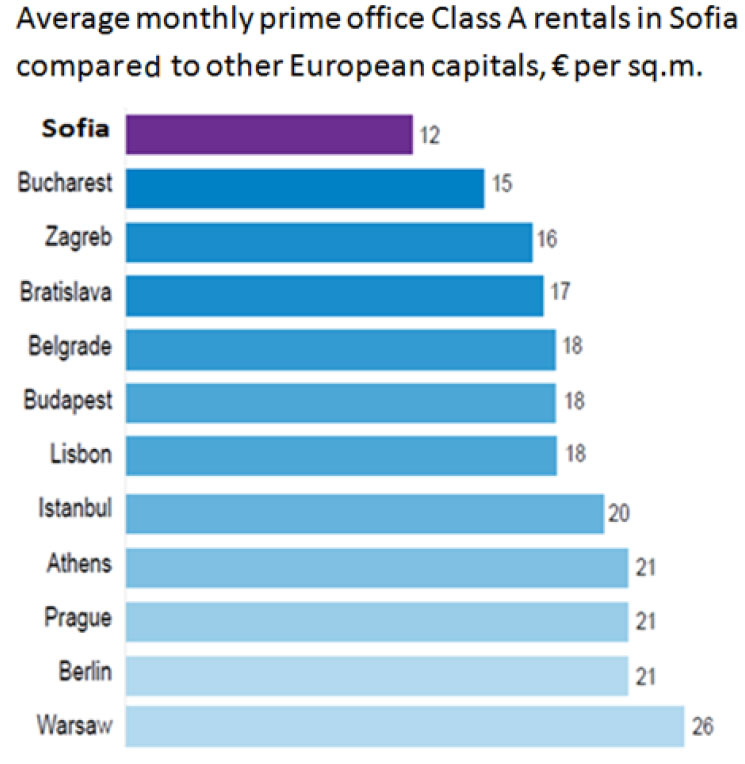

LOW BUSINESS COST

- price of office premises class A 1,000-1,500 €/sq.m

- price of regulated plots 15 €/sq.m

- price of agriculture land 400 €/decare (1000 sq.m)

- Low cost of utilities. Bulgarian cost of electricity for industrial users is 70% of the European average

LOW LABOR COST

- Average salary is lower when compared to other EU countries

- Average salary in Bulgaria € 600/month

- Employees:

-

- highly educated

- experienced

- well trained

- fluent foreign languages speakers

Български

Български Nederlands

Nederlands